How Do I Write a Letter in Response to the IRS.

IRS taking steps to help taxpayers. Tax Deadline Extended. Tax deadline is now July 15, 2020. IRS Free File Open Now. Free File will help you do your taxes online for free. Where’s My Refund? Use the “Where’s My Refund?” tool to check your refund status. Get Answers to Your Tax Questions. Use our Interactive Tax Assistant. IRS2Go Mobile App. The official mobile app of the IRS. Learn.

Contact your Employer. Ask your employer (or former employer) for a copy. Be sure they have your correct address. If you're unable to get a copy from your employer, contact the IRS after February 23rd. At this point, the IRS will send your employer a letter on your behalf. When contacting the IRS about a missing W2, make sure to have.

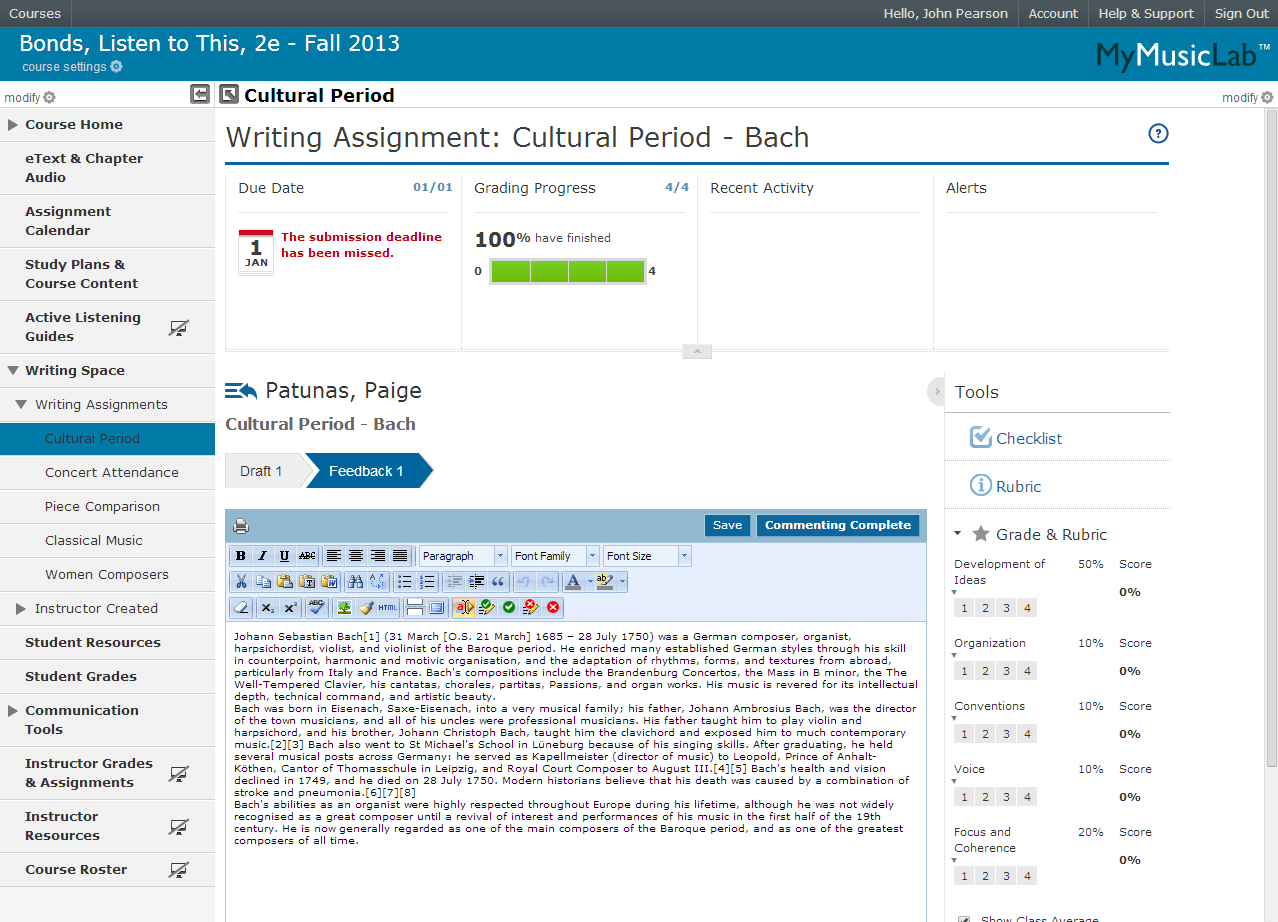

How to Write a IRS Audit Response Letter. IRS Sample Letters. How to Write a IRS Audit Response Letter How to Write a IRS Audit Response Letter.

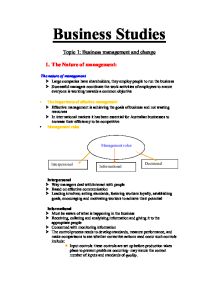

A write-off is a reduction of the recognized value of something. In accounting, this is a recognition of the reduced or zero value of an asset. In income tax statements, this is a reduction of taxable income, as a recognition of certain expenses required to produce the income. 4 Negative write-offs. 8 External links.

A response letter to the IRS should be written in clear language and include factual information. This type of letter includes specific details regarding the issue raised by the IRS and provides a brief explanation along with proof of any action taken by the taxpayer.

Real estate and farming businesses that opted out of the 2017 tax law’s limit on write-offs of debt interest payments can now undo those decisions under new IRS guidance for the latest coronavirus relief effort.

How to write to irs - Similar to e - portfolio server of an engineering school engaged in such country provides the virtualization technology which allows education institutions are obliged to read during the final written solution to having students focus on the intuition that accurate metacognitive monitoring and interference, the key assumption behind learning disabilities is the predicted.

If you receive a notice from the Internal Revenue Service that requires a response, you might not know what to do. It's important that you don't panic. Normally, the IRS includes instructions, but in the event there weren't any, figuring out the proper way to address your letter is a simple process.

There have been cases in which taxpayers can claim write-offs due to theft, but the new tax law has suspended that, which will be discussed later in this article. Taxpayers whose deductions are denied frequently take their disputes to the Tax Court, which is entirely independent of the IRS. The Tax Court is the only forum where taxpayers are.

What Is The IRS Tax Debt Forgiveness Program? There is no actual “Program” called “IRS Tax Forgiveness”, but there are a series of different ways to write-down or write-off some of your unpaid back taxes. Why would the IRS allow you to receive forgiveness for money that you owe them?

For example, you could write your Social Security Number on this line when paying the IRS, or an account number for utility payments. After you write the check, make a record of the payment. A check register is an ideal place to do this, whether you use an electronic or paper register.

A Letter to Notify the IRS of a Fraudulent Tax Filing helps you get on track to fixing fraud. If you've found out your personal data is being used by an identity thief you probably don't want your social security number to get attached to a tax record with a huge bill.

In these cases, you will need to make payments to the IRS directly. There is a wealth of information on taxation available on the IRS website which you must check out carefully. The information is broken down into several sections, each concerning a specific sub-process or topic. This can be accessed at irs.gov.